New and extended federal government supports announced in November to help businesses through pandemic

New and extended federal government supports announced in November to help businesses through pandemic

The Government of Canada in November passed Bill C-9, An Act to Amend the Income Tax Act (Canada Emergency Rent Subsidy and Canada Emergency Wage Subsidy), implementing targeted support to help hard-hit businesses. The measures adopted as part of Bill C-9 include:

- new Canada Emergency Rent Subsidy (CERS),

- new Lockdown Support,

- extension of the Canada Emergency Wage Subsidy until June 2021.

The new Canada Emergency Rent Subsidy (CERS) will provide direct rent and mortgage interest support to tenants and property owners until June 2021. The new rent subsidy will support businesses, charities, and non-profits that have suffered a revenue drop by providing support up to a maximum of 65%of eligible expenses until December 19, 2020. Claims can be made retroactively to September 27, 2020.

The new Lockdown Support will provide an additional 25% through CERS for qualifying organizations that are subject to a lockdown and must shut their doors or significantly restrict their activities under a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws).

The Federal raised the maximum wage subsidy rate back to 75 per cent for the period beginning Sunday, December 20 until March 13, 2021 to help support businesses through the second wave of the COVID-19 pandemic. The wage subsidy is now more flexible, allowing employers to access the maximum subsidy rate based on a single month’s revenue decline instead of requiring them to demonstrate three months’ decline.

Ontario Announces Provincewide Shutdown to Stop Spread of COVID-19 and Save Lives

The Ontario government is imposing a Provincewide Shutdown. Additional restrictions will be put into place and reinforce that Ontarians should stay at home as much as possible to minimize transmission of the virus and prevent hospitals from becoming overwhelmed. The Provincewide Shutdown will go into effect as of Saturday, December 26, 2020, at 12:01 a.m.

The current COVID-19 Response Framework will be paused when the Provincewide Shutdown comes into effect. The impacts of these time-limited measures will be evaluated throughout the 14 days in Northern Ontario and 28 days in Southern Ontario to determine if it is safe to lift any restrictions or if they need to be extended.

New Small Business Support Grant

The government recognizes that small businesses impacted by these necessary public health measures will require additional support so they can continue serving their communities and employing people in Ontario. Which is why the government is announcing the new Ontario Small Business Support Grant, which will provide a minimum of $10,000 and up to $20,000 to eligible small business owners to help navigate this challenging period.Small businesses required to close or restrict services under the Provincewide Shutdown will be able to apply for this one-time grant. Each small business will be able to use the support in whatever way makes the most sense for their individual business. For example, some businesses will need support paying employee wages or rent, while others will need support maintaining their inventory.Eligible small businesses include those that:

- Are required to close or significantly restrict services subject to the Provincewide Shutdown effective 12:01 a.m. on December 26, 2020;

- Have less than 100 employees at the enterprise level; and

- Have experienced a minimum of 20 per cent revenue decline in April 2020 compared to April 2019.

Starting at $10,000 for all eligible businesses, the grant will provide businesses with dollar for dollar funding to a maximum of $20,000 to help cover decreased revenue expected as a result of the Provincewide Shutdown. The business must demonstrate they experienced a revenue decline of at least 20 per cent when comparing monthly revenue in April 2019 and April 2020. This time period was selected because it reflects the impact of the public health measures in spring 2020, and as such provides a representation of the possible impact of these latest measures on small businesses.

Essential businesses that are allowed to remain open will not be eligible for this grant. More information about the Ontario Small Business Support Grant is available here. Further details, including how to apply, will be announced in January 2021.

Ontario Caps Food Delivery Fees to Protect Small Businesses

To support this change, the government will:

- Provide food delivery company employees or contractors who perform delivery services with protection that their compensation will not be reduced in response to these changes.

- Enable restaurants and food delivery company employees or contractors to file online complaints if they are charged fees that exceed the cap or if their compensation or payments are reduced.

- Impose fines of up to $10 million to food delivery service companies that do not comply with the law.

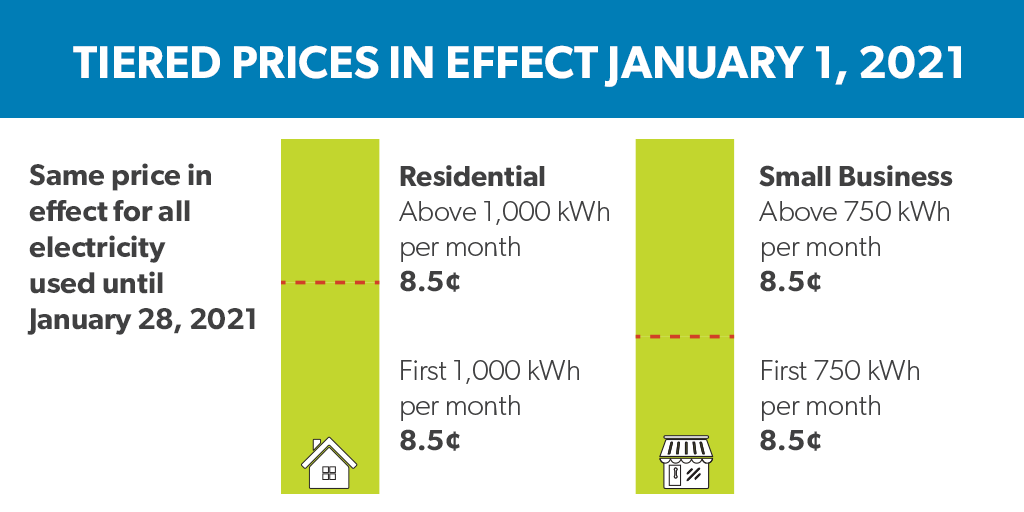

Fixed Electricity Price Starting January 1, 2021

The province-wide shutdown means that more people will be staying home or running their small businesses from home. The Ontario Government has taken steps to hold the price of electricity at 8.5 ¢/kWh for electricity used from January 1 until the end of the day on January 28, 2021. Residential, small business and farm customers on Time-of-Use and Tiered price plans set under the Ontario Energy Board’s Regulated Price Plan will pay that fixed price. So, no matter what time of day you use your electricity, or how much you use, the fixed price will apply. The price change will happen automatically. No customer action is required. For more information, visit oeb.ca